It’s not uncommon for facilities or PPO networks to assert that a claim is DRG-based to deter payors from pursuing further review. On the surface, this might seem like a dead end for an Itemized Bill Review, but that’s not always the case.

When informed that a claim was repriced at a DRG, it’s crucial to dig deeper. With the right questions, you can uncover potential savings. Here are 3 key questions to consider:

- Was there an outlier on this claim?

- If there is an outlier, what is it and how is it priced?

- Is the outlier a percentage of billed, and what is the value?

These questions are essential when handling high-dollar claims under DRG-based contracts. Expion’s Itemized Bill Review could potentially reduce the payable amount, and in some cases, even bring the allowable down below the outlier threshold.

Understanding DRG-Based Pricing Models

DRG-based pricing models come in various forms. The most straightforward is the traditional DRG fee-based model, where a flat fee covers all services. However, high-dollar claims often exceed the DRG allowable and enter what’s known as the “outlier” space. But what exactly does this mean?

The Outlier Space: A Closer Look

The outlier, or stoploss provision, refers to the amount a facility is willing to accept beyond the contracted DRG rate. Here’s how it works in practice:

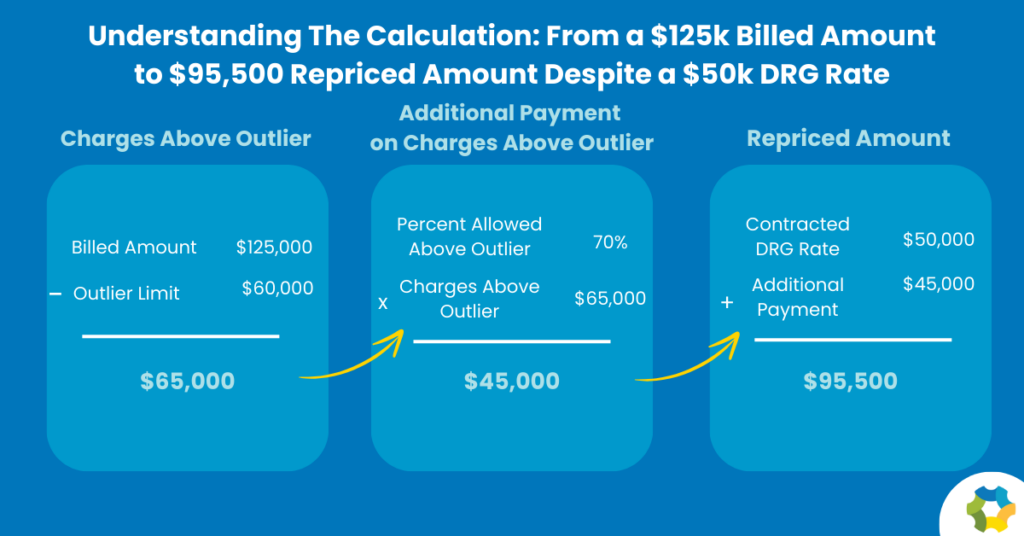

Imagine a patient undergoes laparoscopic surgery for appendicitis, with complications. The DRG code for this procedure is 338 or 339, depending on the circumstances. Let’s say the contracted DRG rate is $50,000.00, but the total billed amount is $125,000.00. The claim reprices to $95,500.00. What happened to the original $50,000.00 DRG rate?

In this scenario, the DRG-based contract includes an outlier provision, allowing charges over $60,000.00 to be paid at 70% of billed. This means the allowable amount is $50,000.00 (the DRG rate) plus 70% of $65,000.00 (the amount above the outlier limit), which totals $95,500.00.

Making Sense of the Math

It’s easy to see how this math can be overwhelming. That’s where Expion’s skilled auditors come in. The outlier portion of the billed amount may be subject to an Itemized Bill Review, where we check for accuracy, unbundled charges, coding conflicts, and more. By identifying these issues, we can reduce the amount subject to the percentage discount, lowering the Plan’s financial exposure and controlling costs.

Conclusion

Expion Health’s Itemized Bill Reviews offer a strategic advantage for self-funded plans looking to maximize savings and minimize financial exposure. Depending on a facility’s discount structure and PPO language, DRG-based pricing models can vary significantly. By questioning DRG-based pricing and utilizing Expion’s expertise, your Plan can achieve significant cost reductions and ensure accurate payment on high-dollar claims.